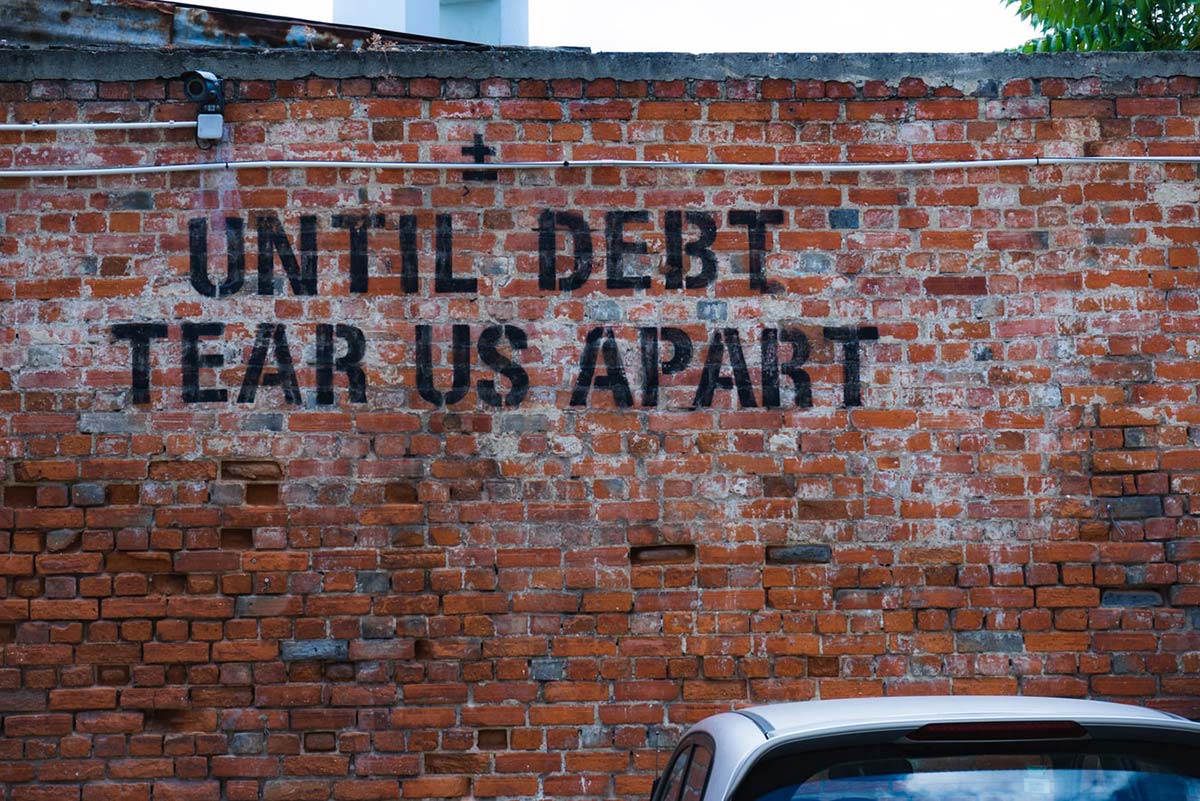

Do you feel overwhelmed by your level of debt? Do you have trouble keeping track of your debts? The good news is it is possible to reduce your debt to a manageable level. Taking action today can help you improve your credit and overall financial situation while saving a significant amount in interest.

Step 1: Get a clear picture of your financial situation Before you can actively work to pay down your debt, you need to assess your situation. Start by getting statements for all of your loans and credit cards, then write down the debt amounts, minimum monthly payments, and interest rates. This will help you after you prepare a budget so you can choose which debts to attack first.

Step 2: Prepare a realistic budget Once you understand your overall financial situation, it’s time to take a good look at your monthly spending and prepare a budget that you can stick to. Your budget should include both fixed expenses — such as home and car loan payments — as well as occasional expenses, such as car maintenance. As you go over your monthly spending, try to reduce your expenses so you can save at least 10% of your net income every month. This money will go toward paying off your debt. Use this list of your debts to decide which debts to pay off first. If you want to save the most money, the debt with the highest interest rate should be your priority. Make minimum payments on all other debts and put everything else toward this debt until it’s paid off.

Step 3: Negotiate lower rates You may be able to negotiate a lower interest rate with your creditors if you have a good payment history. While there is no guarantee, it’s worth your time to contact each creditor individually and ask for a rate reduction. Have a specific rate in mind when you call and be sure to mention how long you have been a customer and the fact that you have a solid payment history.

Step 4: Refinance major loans Once you have credit card debts under control, take a good look at your larger loans, such as home and car loans. It may make sense for you to refinance these loans, as reducing your rate by just a few points can save hundreds every month. Speak with a mortgage broker about refinancing to find out if you qualify and what rate you can expect to receive.

Step 5: Stick with a payment plan Once you have reduced your expenses, lowered your interest rates as much as possible, and decided which debts should be paid off first, make sure you’re committed to sticking with a payment plan to get debt free. It can help to write down all of your due dates and monthly payments on a calendar, and use automatic bill payment whenever possible. Avoid creating new debt and set goals for yourself so you can celebrate each milestone.

Step 6: Consider debt consolidation If you’re struggling with a high level of debt that seems insurmountable, another option to consider is debt consolidation. Consolidating your debts by levering high interest “bad” debt against an asset, such as your home, allows you to get a much lower interest rate. This will give you a significantly lower monthly payment and reduced interest charges. With a single payment at a lower interest rate, you will be able to pay off your debt even faster.

You can learn more about debt consolidation by contacting a mortgage broker like Gerry Orr at 403.249.9650.